Seven out of ten (71%) IT leaders state they spend up to half of their total budget on external technology vendors and service providers. The scale of this capital investment alone — not to mention the time, attention, and focus involved — underscores how important it is for buyers and vendors to rise above the transactional and embrace true strategic partnership.

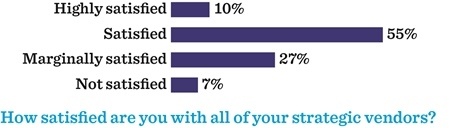

Ask ten IT leaders to define “strategic partnership,” however, and you’ll get ten different answers. The phrase is a desired end-state, a buzzword, or both, depending on who you ask. Vendors, for their part, aspire for the sort of relevance that strategic partnership implies, but according to the CIO Executive Council & IDC 2016 Strategic Partner Index (SPI) Survey, only one out of ten IT leaders is “highly satisfied” with even their most strategic vendors, representing a real risk to IT buyers and vendors alike.

“Strategic partnership,” then, is a term begging for deconstruction. Without context, it’s ambiguous and even problematic. Our definition is simple: Strategic partners are vendors that have gone beyond effective delivery of systems and services to become consistently transparent, responsive, and trusted collaborators in creating value for the enterprise. Vendors that do not meet this mark face commoditization and, ultimately, become an afterthought at renewal time — while competing primarily on price in a race to the bottom.

What Makes the IT Vendor Strategic Partnership Work?

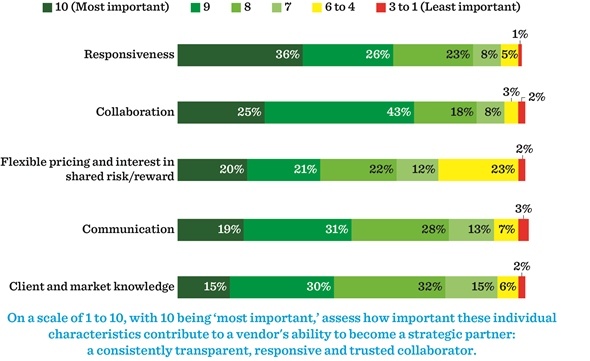

The SPI Research Board, comprised of CIOs and procurement professionals, identified five key areas that make a strategic partnership work (or, at least, work better):

- Client and market knowledge: A vendor’s aptitude when it comes to navigating a client’s organization with relevant, informed guidance — on both market- and business-specific levels. Strategic partners do not appear only when there is a problem or when it is time to pay a bill; they are active, engaged, and market-savvy advisors who can speak confidently about the forces disrupting a buyer’s industry, and provide actionable and consultative guidance.

- Collaboration: The extent to which a vendor is willing and able, within all ethical and legal boundaries, to blur the lines between buyer and seller, bringing in third-party niche players or directly involving buyer senior executives in the development of new offerings, products, or updates/features.

- Communication: Communication is the bedrock of any vendor relationship, and the business-enabling quality that helps drive the success of all other categories. Strategic partners demonstrate honesty and integrity in strategic and project-specific discussions; communication continuity through change; and roadmap alignment.

- Flexible pricing and interest in shared risk/reward: Pricing is both a leading and lagging indicator of a strategic partnership: There can be no partnership at all, much less a strategic one, if a vendor prices their services outside of a buyers’ potential budget — and, once a vendor has established itself as a true strategic partner, price becomes an established cost to demonstrated value. Specific behaviors related to pricing and joint ventures — outcome-based pricing, scope flexibility, and co-innovation — can become the hallmarks of an increasingly fluid and collaborative strategic partnership.

- Responsiveness: A vendor’s ability to respond quickly and effectively to evolving client needs — framed by an account management structure conducive to rapid execution, and defined by an ability to eliminate ambiguity and initiate tough, but effective, conversations.

A definition and key attributes are helpful, but provide limited value if they exist in a vacuum. Here are some select pieces of data-backed guidance from the complete CIO Executive Council & IDC 2016 Strategic Partner Index (SPI) report.

- Give vendors meaningful work — the payoff works both ways. Caroline Faulkner, Chief Operating Officer for Prudential Financial has a refreshing take on partnership. She explains that providing vendors with meaningful work that has a definite technology or business value is very important. You will get more effort, and relevant potential solutions, from vendor staff motivated by interesting tasks allowing them to learn, evolve, and grow. Conversely, people within your own organization will also feel that they have an opportunity to learn more and have related career options.

- Proactivity begins with listening and understanding needs. According to Joel Jacobs, CIO of the MITRE Corporation, it’s not unusual for a vendor, even one that already has a relationship with a company, to suggest a solution to a problem before they fully appreciate its nuances. Make sure that vendors understand exactly what you are trying to achieve and what your ultimate goals are before agreeing to a relationship. While a minority of IT leaders (46%) say their most strategic vendors “have identified challenges within my business that I did not explicitly mention,” happily 72% of them say that their strategic partners “are consultative, advising me on practical and cost-effective solutions.”

- Adopt a “go and see” mindset. According to Brent Waechter, National Manager, Vendor and Asset Management, IT Management, Toyota Motor North America, a major part of Toyota’s corporate vision is defined by Genchi Genbutsu — a Japanese phrase that is literally translated “go and see.” This helps define the vendor management process as Toyota takes pains to get vendors to understand its business challenges.

One key example of this was Toyota’s proactivity in getting vendors on site to learn about the company’s port operations. The effort paid off, Waechter explains: “When Hurricane Sandy came through on the Eastern seaboard, one of our suppliers stepped up and said, ‘Hey, we've heard this thing is coming. We think this is going to be a major event. You've got a port out there.’ And then they took a leadership role in helping organize a recovery process.” A full three out of five IT leaders (62%) state that their strategic partner is willing to change the scope of work without always referring to the contract,” and a ‘go and see’ mentality is a real differentiator.

The result of the organizational, strategic, and even psychological shift to strategic partnership has the potential for massive dividends, according to R. Arun Kumar, SVP Chief Client Officer at Sogeti.

“There are some newer generations of CIOs who are more sharing and collaborative,” he says. “They consider a vendor not as a vendor but as a partner . . . [they] understand our broad vision and make that part of the planning process and visioning exercise. They take advantage of the relationship . . . they don’t try to squeeze us and we don’t try to give off-market rates — which is the best balanced scorecard.”

Base: 121 IT leaders. Percentages may not total 100 due to rounding.

Source: CIO Executive Council & IDC 2016 Strategic Partner Index (SPI) Survey.

Written by Brendan McGowan

Brendan McGowan is Global Media Bureau and Client Research Manager at the CIO Executive Council, where he leads all research efforts.